What financial protection do I receive with Dozens?

We offer a range of financial products because we hold two types of regulatory licences. Our e-money licence allows us to offer a current account and our MiFID licence means we can offer investment products like bonds and thematic investment portfolios.

The Dozens team have worked super hard to bring you all of this together in one app, to create a new home for your money. However, it does mean the protection offered in different parts of the app varies because they are different financial products.

So, below are the details of exactly what protection you have in each area of the app.

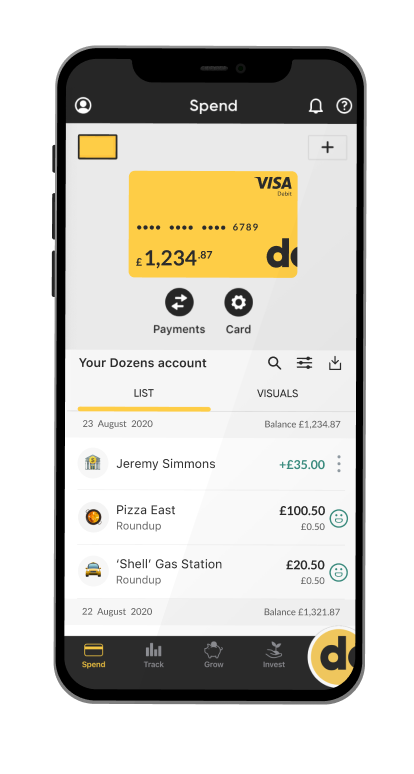

The Spend section

Current Account/Debit Card

The money you see in the Spend section is all part of your current account. This money is securely held in a segregated account at a UK regulated bank in accordance with the FCA requirements and the Electronic Money Regulations 2011.

Dozens is not a bank, this means your current account is not covered by FSCS protection.

Because Dozens is an e-money institution, Dozens has no access to your money for its own purposes. For this reason, unlike with some other current accounts, FSCS protection is not considered necessary as the money does not leave the segregated account and is separate from Dozens’ finances in case of default.

While we make sure your money is safeguarded, and cannot be claimed by any creditors if we happen to go out of business, it is possible that some costs could be deducted by an administrator or receiver. In that case, you should get most, but maybe not all, of your money back. It could also take longer to be refunded than it would with a bank.

If you want to read more about e-money institutions and FSCS protection, you can read more on the FCA and the FSCS websites.

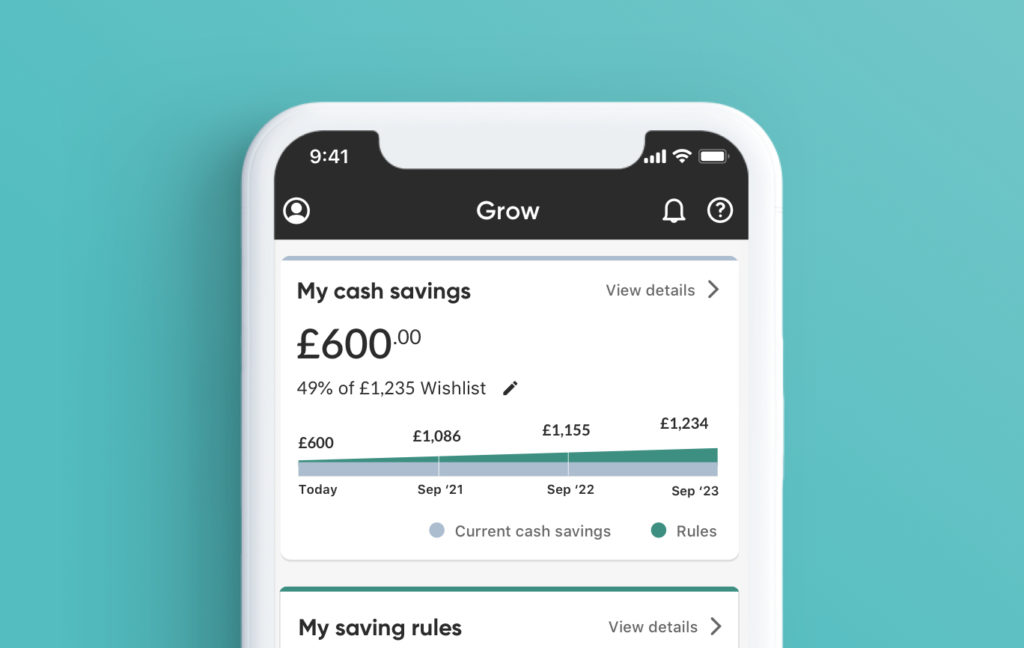

The Grow section

Cash Savings

Your Cash Savings can be found at the top of the Grow section. These are covered by the Financial Services Compensation Scheme (FSCS) for up to £85,000 because we hold them in an account with a UK regulated bank on your behalf. Please be aware any bonds you invest in are not part of cash savings.

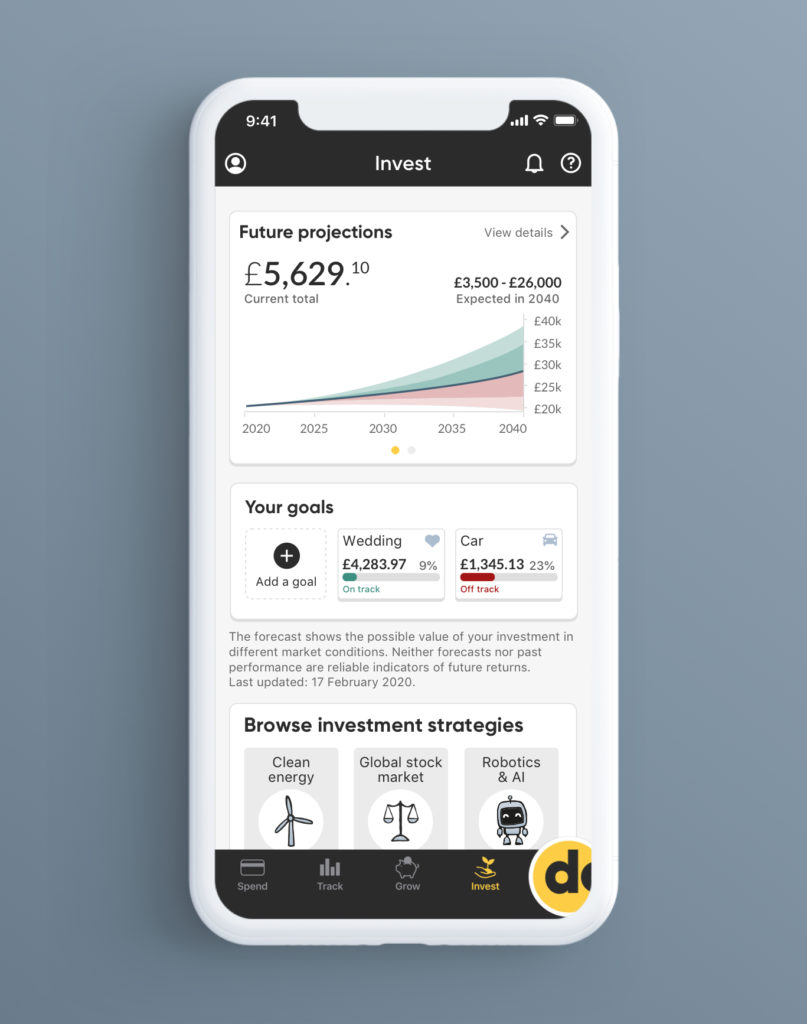

The Invest section

Before you purchase any financial product in the Invest section you will be asked to complete a suitability assessment. This is to determine your financial understanding, experience and security to ensure we’re acting responsibly and only offering financial products suitable to you.

Thematic Portfolios & Multi-asset funds

Our thematic portfolios and choices of multi-asset funds are found in the Invest section. They are exposed to fluctuations in the market, which means that the value of your investment may go up as well as down.

The level of risk varies, which is why we ask you to complete a suitability assessment before you invest, to ensure you’re only offered products suitable to you.

Remember we do not give financial advice, so you should speak to an expert if you are unsure about investing.

Updated 17 June 2021 – adding further clarification about e money accounts not being covered by FSCS protection

-----

Updated 17 July 2020 - Clarification that the listed 5% p.a. Fixed Interest Bonds are allocated, issued and

administered by Dozens Savings Plc.

-----

Updated 20 March 2019 – Details of 5% p.a. fixed interest bonds changed

Dozens is not a bank. Dozens is a trading name of Project Imagine Limited which is a company authorised by the Financial Conduct Authority (FCA) as an e-money institution (FRN 900894) and also as an investment firm (FRN 814281).

Bonds are not FCA regulated products, and FSCS protection does not cover the bonds. Dozens’ Fixed Interest Bonds bonds are allocated, issued and administered by Dozens Savings Plc. The interest offered by Dozens’ Fixed Interest Bonds will not fluctuate even in different market conditions. All of your money to be invested, plus the full 12-months interest, will be placed in a separate trustee-controlled account on your behalf. This would be used to pay you in the event of any default. The bond programme currently has a maximum limit of £7m, with expected issuance volumes of between £100k-£1m a month.