New to investing? Here’s six things to remember when your fund drops.

It’s natural to feel anxious the first time you see your figure go below what you invested, particularly if it’s a large drop. You knew this could happen and you thought you were prepared, but the reality of it feels… well… unnerving.

During any crisis you get such an influx of financial news and speculation, it can leave anyone feeling out of their depth.

When there’s a drop, no one can tell you if and when things may go back to normal. But we can shed some light on what some of it means, and give you a few things to consider.

Know that stock markets are really reactive

They fluctuate every day, but these day-to-day ups and downs rarely make the news because they’re not… well, ‘newsworthy’.

It’s understood and accepted that a couple of percent here and there is ‘normal’ and where there have been drops, there will be rises again.

When these couple of percent turn into double digits, though, people start to panic… causing further drops. Even though that tidal rule of rise and fall is still in motion with the big waves, as it is with the small ones.

Everything from a discovery of oil or tech innovation to a pride parade or political parody can cause fluctuations in the stock market. This is because the stock market acts a bit like a mirror for societies’ sensitivities, and reflects them back to us in its peaks and troughs.

When you think of it this way, it makes sense that the market drops when society is worried about something.

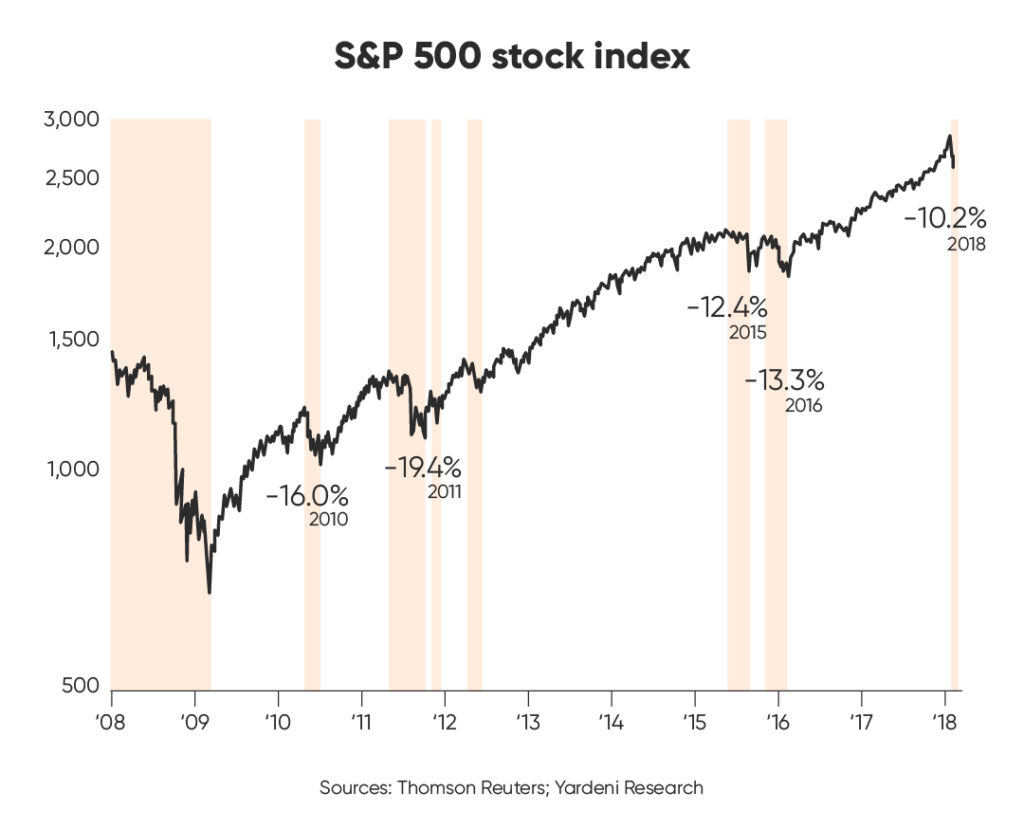

Corrections happen regularly

Among the headlines, you may have heard the term ‘correction’.

A correction is when the stock market falls by 10%. And tends to trigger the first wave of panic.

The thing that is often forgotten, is that corrections are fairly common. On average they happen every couple of years and how long they last varies (but it tends to be measured in days, weeks or months – not years).

Past performance is not a reliable indicator of future results

These regular drops are the market’s way of ‘correcting’ itself, after a time of companies being overvalued. Prices fall to a point of stability and the market is ‘corrected’.

Corrections don’t mean a recession is inevitably coming and they mostly only impact short-term investors. This is because you only actually lose money if you sell your investment when the value has dropped. If you invest for the long-term, short-term corrections are likely to make little or no impact on your investment.

Bear markets are not rare

With most corrections, the stock market drops and then returns to where it was (or higher) over time.

If the stock market continues to drop and falls by 20% or more, it’s then termed a ‘bear market’. It’s called a ‘bear’ market because of the way a bear attacks, swiping its paws downward.

As of March 2020, the S&P 500, the Dow Jones and the FTSE 100 went into a bear market in the UK and the US.

Bear markets have the potential to last longer than corrections and aren’t quite as common, but they’re still not defined as rare. Between 1900 and 2018, there were 33 bear markets, averaging one every 3.5 years. Throughout its history, the stock market has recovered – and gone on to prosper – from bear markets.

So what is a ‘recession’? A recession is more about the length of time the market is down, than the amount it has dropped. It is typically recognised as two consecutive quarters (six months) of economic decline. And is more a recognition of slow recovery than a suggestion of future events.

Human instincts don’t lend themselves to investing

We’re hardwired as humans to survive. Any perceived threat flicks our brain into ‘fight or flight’ mode and our survival instincts take over.

While this response is helpful in lots of real life situations, it’s less so when you can’t help but instinctively see financial losses as mortal threats. When this happens, it’s natural to then want to take flight.

Also, we’re pack animals. The impulse to follow the crowd is built within us as a survival instinct, and this is true for investing, too. When we see stock markets falling, and we hear that other people are selling their assets, it’s natural to feel like we should join them to keep ourselves safe.

Instinct can push us into reactive decision making, and we can’t blame ourselves for that. But being able to take a step back, and looking at the data, rather than responding to emotions, is invaluable.

Thinking past the short-term is recommended

While we can’t tell the future, we can be guided by the past, and what history tells us is that the world recovers.

Time and time again we’ve faced challenges as a species, and each time we rise up, overcome and surpass where we were before… but you have to be in it for the long-haul to see the other side. When you focus in on drops, they look devastating, but when you take a step back and look at the bigger picture, it doesn’t look quite so worrying.

Past performance is not a reliable indicator of future results

Your emergency fund is there if you need it

When you invested, as part of your suitability assessment you completed an affordability check. This asked you if you have three months expenses put aside in an easy access account.

This emergency fund is there for you to lean on if you unexpectedly need access to cash, so you’re not forced to sell your investment when the market is down. It means you can make proactive decisions rather than reactive ones.

In conclusion, it’s natural to feel nervous the first time you see your fund drop

But remember:

– Markets are emotional

– Corrections are common

– Bear markets are not rare

– Your instincts can’t always be trusted

– Focus on the long term

– Your emergency fund is there should you need it

We wanted to take this opportunity to remind you that, if you hold an ETF with Dozens, our 0.5% platform fee will not be charged on days the value of your portfolio closes below the total amount you’ve invested. This is as part of our commitment to ‘only do well when our customers do well’.

Capital at risk. When you invest your money is at risk, as the value of your investment may go up as well as down and you may not get back the amount you originally invested.